To simplify reporting and to promote the best customer service for students and their families, the University of California contracts with TAB Services to provide the 1098-T form.įor more information, please visit the TAB Services website or call TAB Services Customer Support toll-free at (888) 220 2540.Īll US citizens, resident aliens, and nonresident aliens who intend to or who will file a US income tax return for the purpose of receiving an educational tax credit need to provide their SSN/ITIN to the university. Please use Worksheet 1-1 in IRS Publication 970 (Tax Benefits for Education) to figure the amount of a scholarship or fellowship grant you can exclude from gross income.

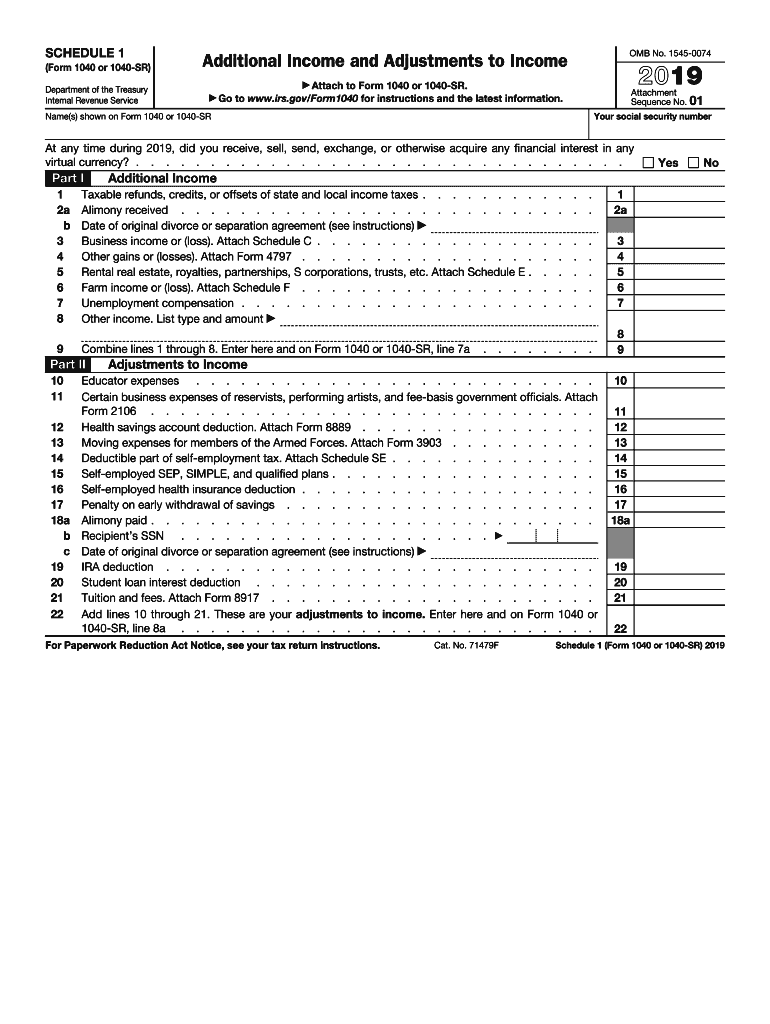

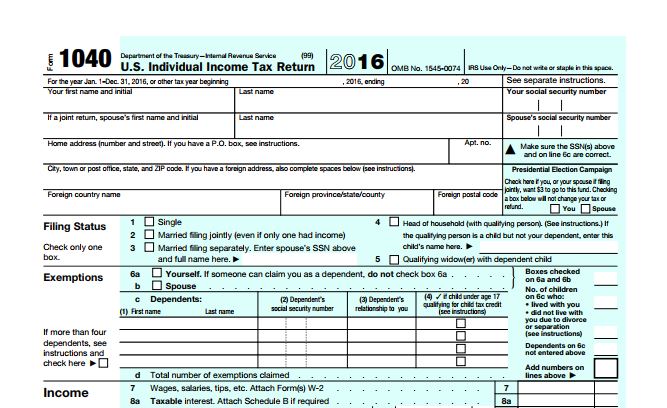

The university does not report scholarship or fellowship income to you or to the IRS. The 1098-T form is not intended to be used for determining any taxable income you may have received from scholarship or fellowship payments. Loans are excluded and not reported on the 1098-T form. Included in the 1098-T form are qualified charges that were paid and financial assistance received for the corresponding tax year. As an eligible educational institution, UC Berkeley reports certain financial and identifying information regarding US resident students for which UC Berkeley has received payments of "qualified education expenses" for the corresponding tax year. The 1098-T form is used by eligible educational institutions to report information about their US resident students to the IRS as required by law. General Information about the 1098-T Form

0 kommentar(er)

0 kommentar(er)